If it looks properly connected, try unplugging and reconnecting both sides of the cable. If you already have an active printer station, ensure that you have enabled Receipts under the "Use this Printer For" setting - this will ensure your cash drawer will open automatically.Įnsure that your interface cable is properly connected to both your printer and cash drawer. You can enable a printer station by navigating to ≡ More > Settings > Hardware > Printers > Create Printer Station. Make sure you have created and enabled a printer station for your receipt printer. If you’re using a printer-driven cash drawer to connect to a supported receipt printer, try the following tips: Learn more about our supported cash drawers and hardware compatibility. When you connect a cash drawer, it will automatically open when you accept a cash payment and you can take full advantage of Square’s cash drawer management features. Whether you're using a USB or Printer-Driven cash drawer, try the following troubleshooting tips below to get your cash drawer back up and running.īefore you get started, please note you can connect a cash drawer directly to your Square hardware or through your receipt printer. She does one-on-one mentoring and consulting focused on entrepreneurship and practical business skills.Printer-Driven Cash Drawers USB Cash Drawers Cash Drawer Support In 2013 she transformed her most recent venture, a farmers market concession and catering company, into a worker-owned cooperative. Accessed July 22, 2020.ĭevra Gartenstein founded her first food business in 1987.

"Statement of Financial Accounting Standards No.

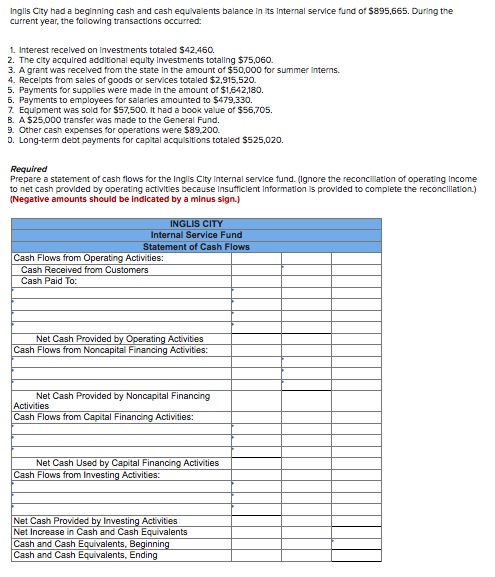

Your cash flow statement should have lines to represent every category of cash that may come in, such as retail and wholesale sales, rental income and business loans. You may also have sources of cash that aren't directly connected to earnings, such as capital infusions from loans. But you'll have more money than this to work with during the first month or quarter because your company will earn and collect money during this time.

It is the result of business activities that occurred prior to the time period covered by the statement. The formula for your beginning cash balance at the start of the earliest period covered by the statement shows how much money you have going into the period represented by the very first column. Each column in your cash flow statement represents an accounting period such as a month or a quarter.

0 kommentar(er)

0 kommentar(er)